A Beginner's Guide to ETRM: Measuring Mark-to-Market for Energy Trading Risk Management

When it comes to energy trading risk management, valuation metrics are vital to making data-driven decisions. Due to the complexity of risk management, many companies invest in an ETRM (Energy Trading Risk Management) system to monitor their portfolio and measure their risk through various built-in valuation metrics.

One of these metrics is mark-to-market value, one of the most fundamental to risk managers, which gives you a fairly standard opinion of value.

Since this metric is essential to energy trading risk management, we’re providing you with a beginner's guide to mark-to-market.

Table of Contents

- What is MtM for Energy Trading Risk Management?

- Why is MtM Important in Trading and Risk Management?

- What are the Limitations of MtM?

- How Do ETRMs Help Track MtM?

What is MtM for Energy Trading Risk Management?

Mark-to-Market (MtM or M2M) value reflects a position's current worth from the perspective of the price at which it is transacting on the market today people are buying and selling it for.

The formula for calculating MtM is relatively straightforward but may vary slightly depending on the type (and direction) of the transaction. For example, this is the formula for calculating MtM for a purchase transaction:

- MtM = (market price - (prior market price, or purchase price)) x quantity

For a sale transaction, the equation would be inverted, as shown below:

- MtM = ((prior market price, or sale price) - market price) x quantity

The market value changes over the trade's life. MtM helps you to answer the question, roughly, how much money would I make or lose if I sold everything right now?

Why is MTM Important in Trading and Risk Management?

In aggregate, MtM is a clear, fundamental measurement of your portfolio’s value. It's also essential to other vital metrics, such as exposure and risk.

For instance, MtM is the assessment of exposure, and risk is the differential between the two. With MtM, you can get a better understanding of the value of your portfolio and adequately measure risk and exposure.

Moreover, MtM is much more concrete than other metrics, such as Value at Risk (VaR) and scenario analysis, which are more hypothetical.

What are the Limitations of MTM?

MtM is a fairly simple and complete metric, but its essential ingredient, a market price (also referred to as a mark), can be expensive, difficult, or even impossible to find for some illiquid instruments. In those cases, people sometimes provide “dirty” substitutes or use an internal model to generate a mark.

Although MtM is a valuable metric, some additional factors can add to the complexity of the calculations. These include:

- Volatility and veracity of the market

- High liquidity

- Price impact

- Contract complexity

- Non-linear trades, such as options

- Interest rate risk

- Time to maturity

- Spread

- Market or location limitations

Although these factors can make it challenging to get a clear view of your MtM, it is still one of the most essential, accurate metrics you can use.

There can be some disputes on how to calculate MtM because, while there are multiple formulae that are commonly used, the names for each are not standard. The two most common are what we call MtM change and unrealized P&L.

Here are the formulas we use for each:

- MtM Change = (market price - prior market price) x quantity

- Unrealized P&L: (market price - transaction price) x quantity

How do ETRM (Energy Trading Risk Management) Systems Help Track MtM?

ETRM/CTRMs pull your trade and market data together in one tool and consistently do the same calculations. ETRM/CTRMs are an effective risk management tool because they can do this at scale and accurately. You can easily assess and manage your trade portfolio more accurately and quickly.

Want to learn more about how an ETRM helps you manage risk? Check out our blog, "3 Ways to Use CTRM Software for Day-to-Day Risk Management."

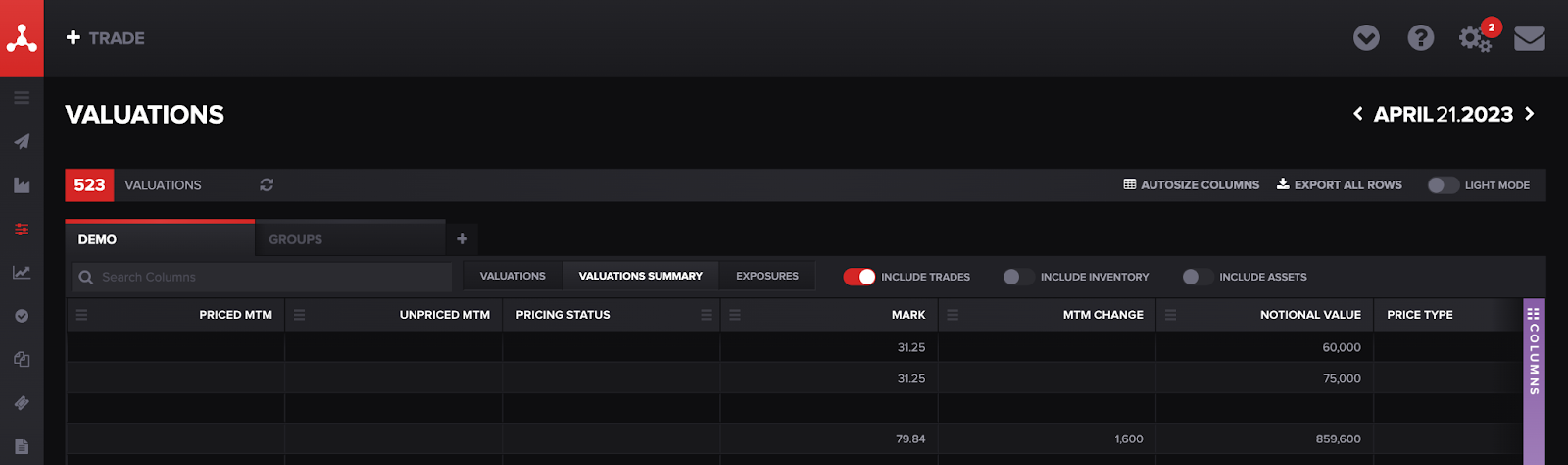

ETRM/CTRMs make these MtM calculations readily available. In Molecule, you can access MtM valuations in a variety of ways, including through our API or directly from our interface.

ETRM/CTRMs show the full lifecycle of a trade, so you can see how today's MtM compares to yesterday's, last month's, or last year's MtM.

Ultimately, ETRM/CTRMs are better suited for managing your portfolio than other risk management solutions because they handle complexity effectively, have built-in integrations for near real-time data, and automate valuations and reporting, such as MtM.

RELATED POSTS