A Beginner’s Guide to ETRM: How Can ETRM Systems Handle Actualization?

Renewable and physical commodity management is an important function of ETRM systems. Your software should be able to capture and model the full lifecycle of your physical trades – from transaction to delivery.

Read on to see how ETRM systems model the downstream operations of physical commodities through actualization.

Table of Contents

- How do ETRM systems capture actualization?

- How do ETRM systems track renewables and physical commodities?

- How do ETRMs track physical commodities differently than other software?

How do ETRM systems capture actualization?

ETRM systems capture the full lifecycle of physical and financial trades and calculate their forward positions. However, physical trades are handled differently than financial ones. Although renewable credits are not exactly physical, they have a similar delivery process to other physical commodities.

Since actualization is an important part of managing physical and renewable trades, it’s often baked into ETRM systems.

“ETRMs have had to develop a way to ‘deliver’ physical things, and they coined terms like ‘actualization’ or ‘linkages and movements’ to represent, through software, what happens in real life.” - Kevin Dattatreyan, ETRM/CTRM Implementation Analyst

These “linkages” connect multiple trades or storages to represent the movement of a commodity down the pipeline.

How do ETRM systems track renewables and physical commodities?

Since physical trades don't have a definitive end date, they need to be modeled differently than financial trades. So, here’s how ETRM systems manage renewables and physical commodities:

- Track and compare actual volumes when commodities schedule, ship, or arrive at contracted volumes

- Compare contracted renewable credits with physical credit deliveries

- Manage, mark, and true up inventory buckets directly (as opposed to only via physical trades)

To give you a better idea of how ETRM systems handle physical commodities, we’ll show you one of the ways that Molecule supports easy actualization.

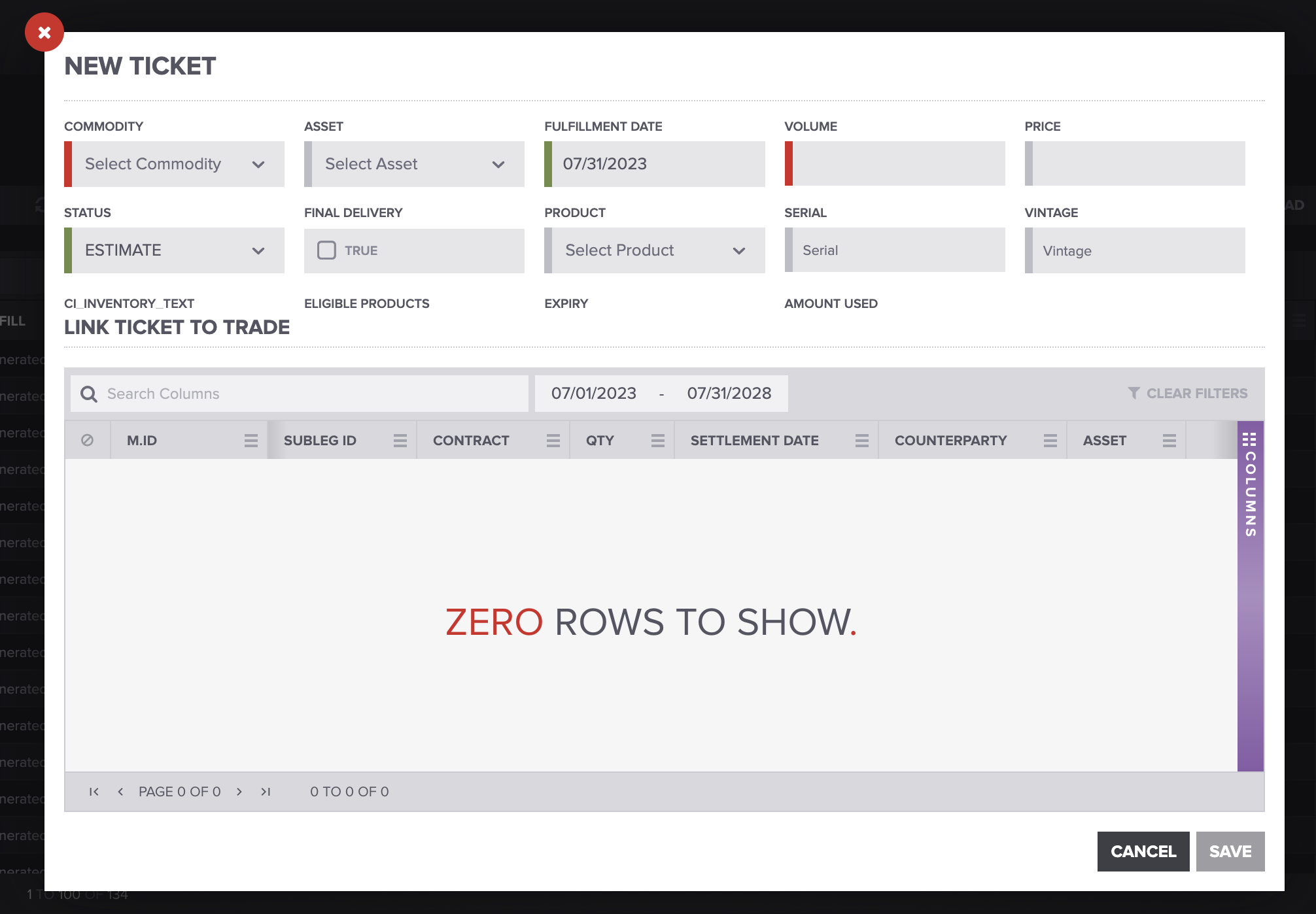

You can represent trade deliveries of a contracted physical commodity with Molecule’s Inventory Tickets feature.

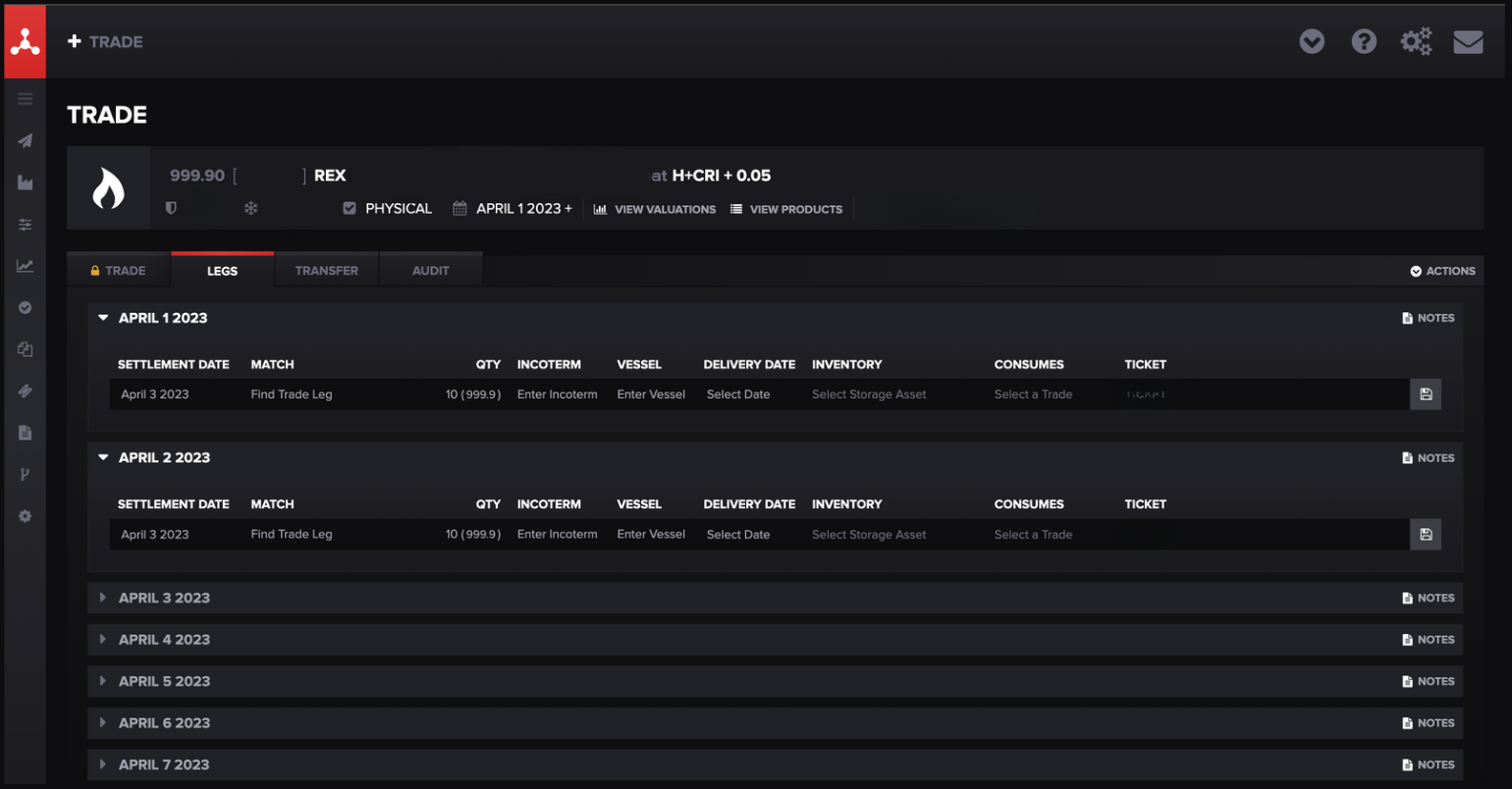

Once a ticket is created, it can be linked to a trade to signal its delivery. Physical trades have sublegs, which track a trade’s settlements.

Here are the different ways you can link tickets:

- An entire subleg’s unsettled volume to a settled subleg

- A part of a subleg’s unsettled volume to split a subleg into settled and unsettled quantities

- A part of a subleg’s unsettled volume to actualize and settle the subleg and match the ticket volume

- Link to assets to bucket inventory

How do ETRMs track physical commodities differently than other software?

ETRMs have built-in features to model storage, transportation, and deliveries. You would have to build out those features yourself if you’re using another solution, such as spreadsheets or an in-house ETRM, which is challenging and not optimal for a variety of reasons.

ETRMs have additional features for physical commodity management. Here are some of Molecule’s features:

- Built-in product mapping

- Market and exchange data integrations

- ICE product standardization

Since ETRMs automate and consolidate your trade and market data, it can enable easy tracking and reporting.

If you’re evaluating how different ETRMs handle the trading of renewable or physical commodities, look for one that’s not too rigid in how it handles the actualization process. Your ETRM should be flexible enough to manage a variety of commodities, not just a select few.

In turn, if you’re trading renewables or physical commodities, you should invest in a solution designed to handle their storage, transportation, and settlement.

RELATED POSTS