ETRM/CTRM Solutions for Independent Power Producers

World-leading IPPs rely on Molecule's intuitive, reliable ETRM software to get generation, production, complex deals, and hedges for power trading into a single, automated, consolidated view.

Model Assets, Structured Deals, and Exotics

Through our Assets feature and API, Molecule offers the ability to model virtually anything, in the system that can handle it best.

For every asset, structured deal, or exotic, Molecule makes a daily or on-demand call to a valuation model (yours, ours, or QuantLib's)—or an external system or database. It stores a full suite of valuation and position information, and reports it alongside everything else in your portfolio.

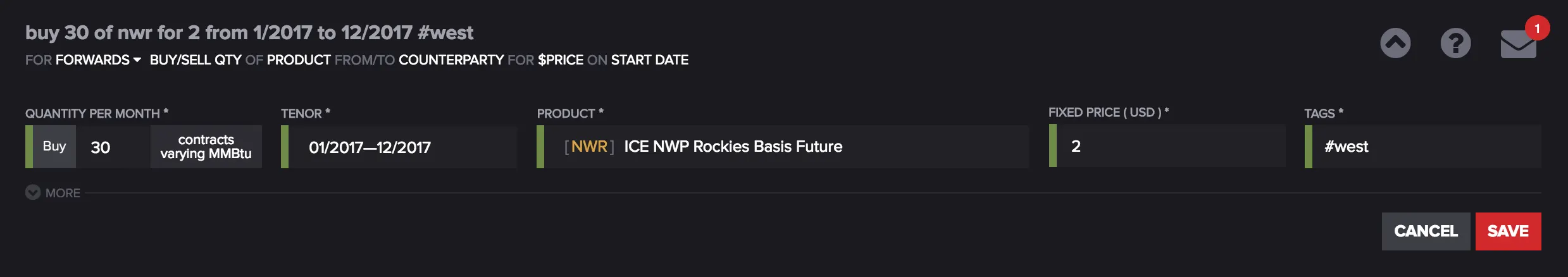

Model Hedges

With Molecule, your trades flow in instantly, through our built-in ICE, CME, Nodal Exchange, Trayport, and ISO connectors. Trading elsewhere? Use our spreadsheet upload, our API, or even better—our natural language recognition for OTC trades.

Market data comes your way automatically (and for free, in most cases), using our out-of-the-box market data service.

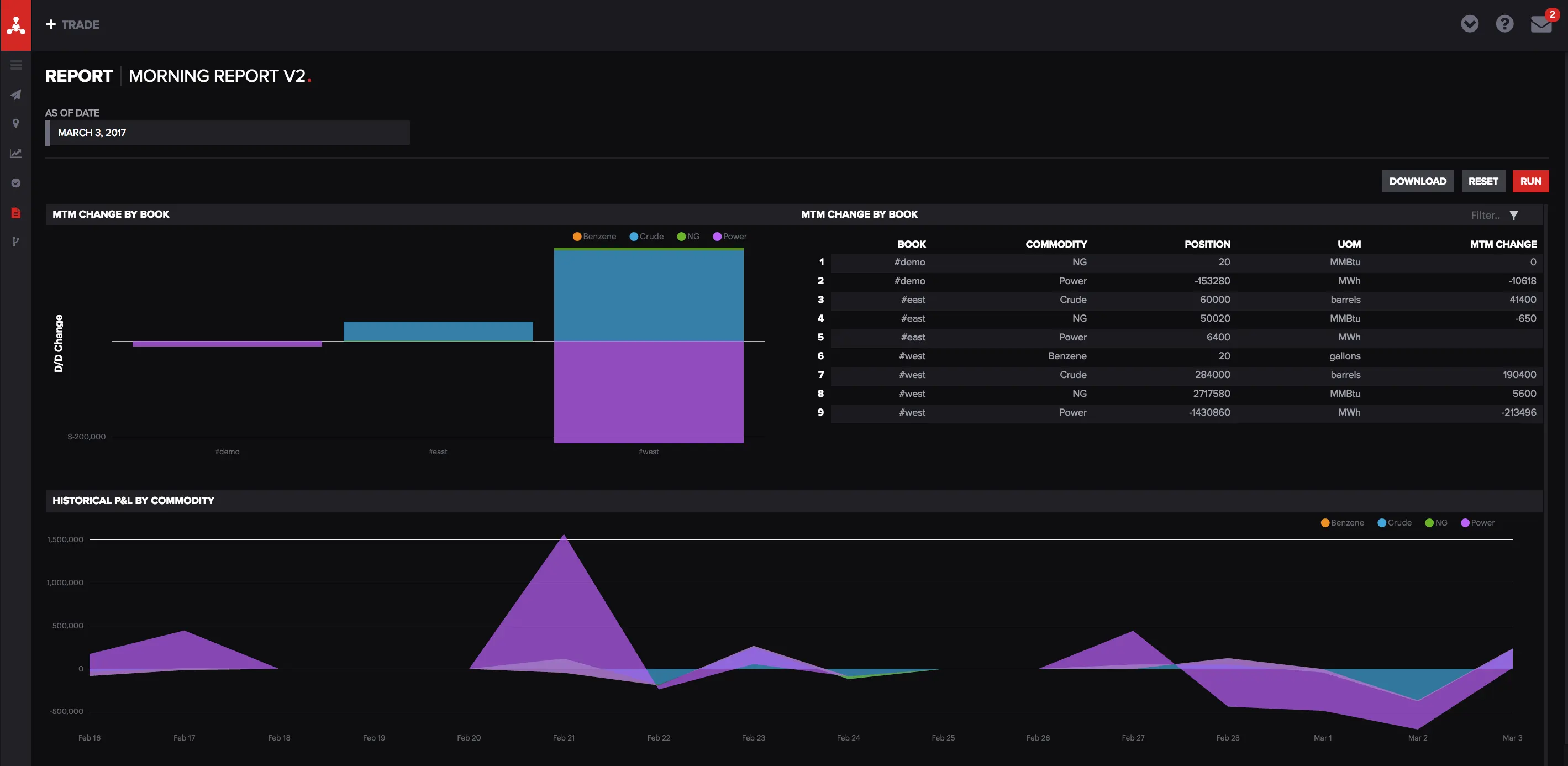

See Your Combined Exposure, Automatically

Molecule produces rich, insightful custom reporting—with your input as to what it should contain. View it on-screen, have it e-mailed, or automatically generate fine-grained tabular reports suitable for your users or customers. Then go home early.