ETRM/CTRM Solutions for Advisors

Manage diverse portfolios in our modern, reliable energy and commodity risk management platform, complete with advanced analytics, position reporting, and flexible APIs.

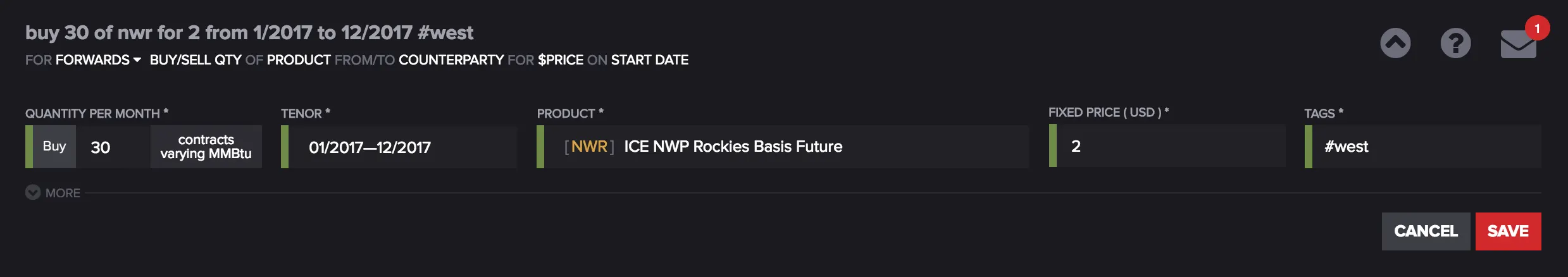

Trade and Market Data

With Molecule, import vast amounts of trade and market data through our APIs and natural language deal capture. Trading on electronic platforms? Your trades flow in instantly, through our built-in ICE, CME, Nodal Exchange, Trayport, and ISO connectors.

Production and Generation data

Through our Assets feature and API, Molecule offers the ability to model virtually anything, in the system that can handle it best.

For every asset, structured deal, or exotic, Molecule makes a daily or on-demand call to a valuation model (yours, ours, or QuantLib's)—or an external system or database. It stores a full suite of valuation and position information, and reports it alongside everything else in your portfolio.

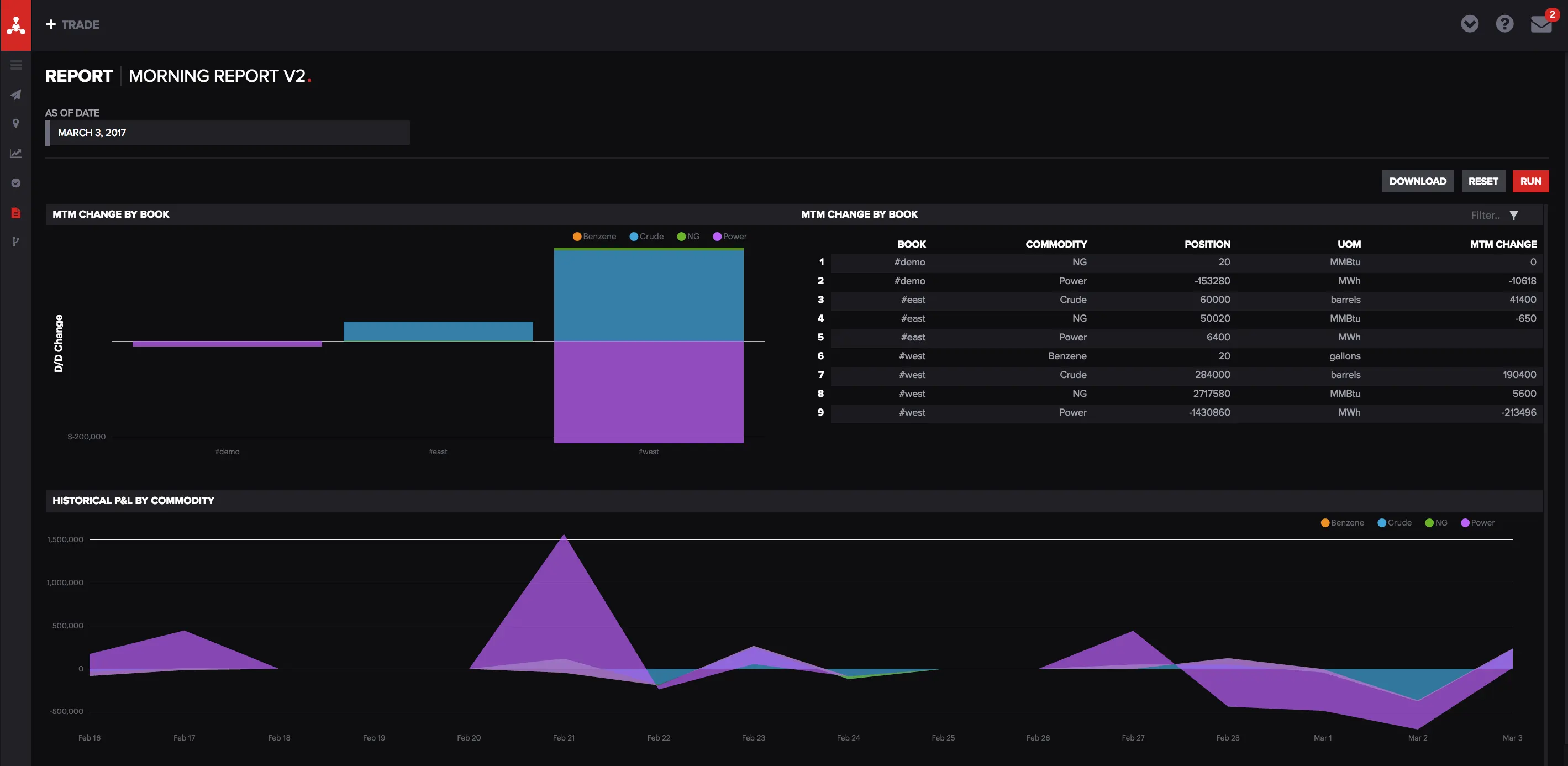

Automatic Position, P&L, RISK

Industry-standard, battle-tested calculations power our mark-to-market and option models. Once trades and market data arrive, Molecule churns through your portfolio, producing positions, P&L, and risk—in no time flat.

Automate customer reporting

Generate settlement statements, confirmations, and other custom reporting. Load it anywhere you'd like, and forward at will. Do it reliably, day after day.