What's the Best ETRM Software for the Global Energy Transition?

How to determine the best ETRM software for the energy trading transition with renewable credit and offset management and regulatory monitoring.

4 Ways ETRM Software Vendors Give You a Competitive Advantage

Discover how ETRM systems provided by leading ETRM software vendors give a competitive edge by adapting to industry changes, standards, and more.

How to Prepare for a Successful ETRM Software Implementation

Here’s how you can prepare for a successful ETRM software implementation, complete with essential steps, tips, and a free checklist.

Thoughts from Commodity Trading Week Americas: Digitalization in the Energy and Commodity Trading Industry

Explore what digitalization means in the context of energy and commodity trading from leading experts at a Commodity Trading Week Americas panel.

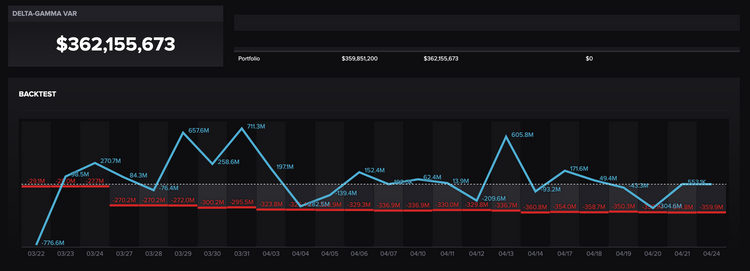

3 Ways to Use CTRM Software for Day-to-Day Commodity Risk Management

Check out why CTRMs are valuable tools for companies trading energy and commodities to manage and monitor daily trading, market, and credit risk.

How to Structure an ETRM Software Purchase Decision [+ Free Template]

Learn the best ways to prepare to buy an ETRM that meets your company's needs and budget. Download our ETRM purchase process template here.